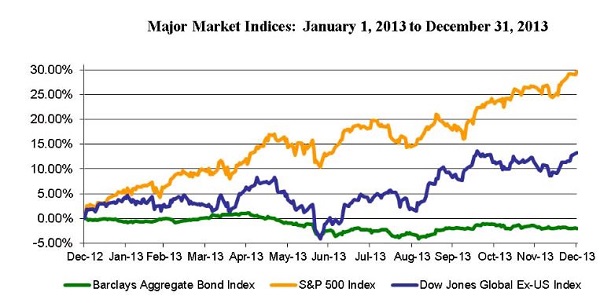

U.S. stocks dominated investment returns in 2013 as the S&P 500 index posted a 30% return, the strongest since 1997. Investors rejoiced in continued economic recovery as well as continued easy money policies extended by the Fed.

It was a year when U.S. stock markets maintained positive year-to-date returns on every trading day of the year, following an almost perfect upward trajectory in the fifth year of a bull market.

Returns elsewhere were more mixed.

International stocks finished the year up 13% measured by the Dow Jones Global ex-U.S. Index. Bonds ended the year down 2% measured by the Barclays Aggregate Bond Index, which experienced only its third loss over a 28-year stretch. Commodities and gold felt some of the most significant losses, down 9.6% and 28% respectively.

All told, returns were varied for the year, but certainly positive on the aggregate, helping to bolster account values and wealth creation.

Headlines Of 2013 And Their Bearing On 2014

Looking back upon 2013, SageVest Wealth Management notes three headline topics that dominated investment news: government dysfunction, interest rates, and Fed tapering.

Government Dysfunction

Congressional approval figures suggest that not many people are enamored by the performance of their elected officials. Yet, from a market standpoint, this sentiment and the impact of more than two weeks of a Federal government shutdown were essentially meaningless. Looking forward to 2014, we likewise expect little government impact on the investment markets.

Interest Rates

Of the three headlines, interest rates might have had the greatest impact on both stocks and bonds. Interestingly enough, divergent moves in interest rates generated the same end-result of driving investors toward equities. Investors sought higher returns from stocks as yields on bonds declined through the beginning of 2013, and later fled toward stocks in fear of losing money on bonds as rates moved higher. Rates increased significantly from a low of 1.6% to close to 3% on the 10-year Treasury at year-end, causing bonds to lose value in 2013. However, we think it is notable to consider the following:

- Losses incurred by bonds were fairly modest at 2% (benchmark above), which we don’t exactly consider to be the ‘falling knife’ that so many articles suggested about bond performance.

- The prospect of Fed tapering sent rates much higher in 2013, but little movement has occurred in rates since the Fed formally announced plans to taper.

- Many economists and bond analysts believe that although interest rate could trend higher, the bulk of the move in interest rates might have already occurred in 2013.

- The 10-year Treasury yield now exceeds the S&P 500 dividend yield, possibly encouraging long-term bond investors to reconsider bonds if interest rates stabilize

Fed Tapering

While interest rates might have had the greatest impact on 2013 market performance, Fed tapering certainly dominated investment headlines. Initial discussions about tapering in May prompted a short-term market pullback as investors fretted about the prospect of continued growth without Fed support. However, the markets quickly chose to ignore the potential of tapering, in large part because of lackluster economic data that suggested the Fed would defer any action. By the time the Fed did announce tapering on December 18th, stronger economic data allowed stock investors to rejoice in the news with the prospect that the economy and hopefully the markets can continue to grow, even while the Fed begins to retreat.

Now What?

After such a strong stock market rally in 2013 and announcement of the long-anticipated Fed taper, investors are left pondering, “Now What?”. We are generally optimistic as we look forward, but caution investors to have realistic expectations, in part because of the longevity of this bull market. The S&P 500 is now in its sixth longest bull market in history, and the fourth strongest in terms of performance.

Realistically, market timing based upon predictions can be a fool’s game. We adjust portfolios based upon economic and market indicators as available, but always maintain exposure to varying types of investments as we recognize that unpredictable events (both positive and negative) will inevitably occur. As we navigate forward, we offer the following observations with regard to investment positioning:

Historical Observations

If history has any bearing on the future, according to ISI Research, there have been 11 years since 1950 in which the S&P 500 has posted 25% plus gains. In 9 of the 11 years following, the S&P posted positive results, with an average gain of over 16%. This bodes well looking to 2014. Conversely, if you look at the past three years in which a new Federal Reserve Chairperson was appointed, each new Chairperson experienced significant challenges shortly after taking office.

Economic Indicators

If we look to the economy, the prospects of continued growth appear to be strong. Strength in consumer spending, business investment, manufacturing, energy output, housing and the job market suggest that the main cylinders of our economic engine are doing well. Furthermore, a surge in corporate borrowing combined with economic stability could instigate businesses to expand hiring and business spending. Also, contractions in government spending are expected to have a smaller economic impact in 2014, allowing private sector growth to count more toward overall economic figures. Bottom line, economic growth is encouraging and supports continued exposure among domestic stocks.

Central Bank Actions

Despite the Fed’s announcement to reduce future bond purchases, the Fed remains firmly committed to supporting continued recovery. Other central banks are actively engaged, namely in Europe and Japan. Looking forward, reduced bond buying by the Fed could have some impact on market potential. However, we are encouraged by the fact that world central banks remain committed and ready to participate, and that the Fed can easily alter course, if necessary. Central bank support is encouraging for stocks in 2014.

Inflation

The recent rise in interest rates and actions by the Fed have prompted discussions about inflation. Overall, inflation remains fairly benign. A number of variables can impact inflation, but realistically, there are two primary drivers – wages and capacity utilization. A resurgence in our manufacturing sector is creating some capacity concerns as many manufacturing plants are approaching full production levels. This could lead to infrastructure spending to meet capacity and/or higher prices. However, while capacity is a valid concern, we expect inflation to remain fairly low because of the second primary driver – wages. Wages remain historically low, with actual declines on an inflation-adjusted basis. Ultimately, unless wages begin to improve, we expect pricing pressures to remain intact simply based upon purchasing power. Modest expected inflation could bode well for both stocks and bonds alike.

Value Of The Dollar

One variable that gives us pause is a recent rise in the U.S. dollar. A weak dollar environment over the past several years has encouraged economic recovery as it makes our goods and services cheaper in the global marketplace. The Fed’s easy-money policies have helped to support a weak dollar, but those policies are now reversing and drawing money back into the United States, which is pushing the dollar higher. We still believe the U.S. remains competitively positioned in the global environment, but a rising dollar is a factor to consider as our exported goods become more expensive to purchase. From an investment standpoint, a rising dollar could benefit US investment returns, but could ultimately support stronger international growth if other countries gain a pricing advantage.

International Recovery

Economic and investment performance remains mixed on the international front, but several factors are drawing attention to international investment potential. The U.S. has led the world out of recession and our markets have outpaced international performance as a result of faster recovery. That said, the world economy is improving. Notably, an important turnaround is happening in Europe. European leaders are more firmly committed to supporting growth rather than mandating austerity, and the President of the European Central Bank has clearly stated his pledge to support continued recovery through monetary efforts.

It is important to remember that stock market performance is typically indicative of future economic performance. This means that the markets tend to decline in advance of economic contraction and tend to rise in advance of full economic recovery. A more solid economic recovery in the U.S. offers support for continued performance in U.S. stocks. However, the infancies of international economic growth combined with lower valuations and higher dividend yields among developed country markets provide attractive considerations for international stock market exposure. We have been modestly increasing international exposure in light of these considerations.

In Summary

The prospects for continued global economic recovery are encouraging. A number of positive factors support continued strength in stocks, albeit possibly with more modest returns. International stocks are also looking attractive. Interest rates could continue to move higher in 2014, but we expect that the Fed will be carefully watching the economy with a keen eye on interest rates, and that they won’t allow rates to move too high too fast. Finally, we recognize that unforeseen events can happen, and the corresponding need to maintain a long-term investment outlook that rewards investors over a full economic cycle.

As always, we encourage you to CONTACT US with any questions.

If you found this article of interest, please SUBSCRIBE.