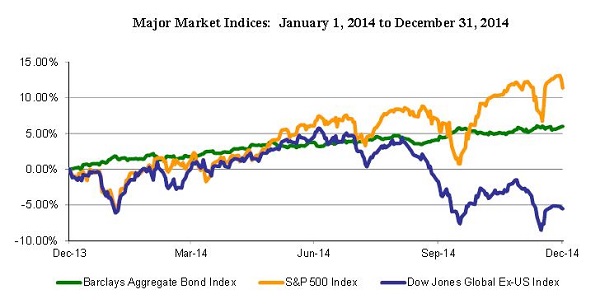

2014 was a banner year for the S&P 500 and the Dow Industrial Average as both indices set new records.

While the celebrations were joyous, they were also lonely when we look broadly across the investment markets. Smaller US companies posted meager returns after trending flat to negative for much of the year. International stocks had a less favorable outcome, ending down for the year in the wake of a global economic slowdown.

In addition to disparate returns, 2014 was a year of unexpected events that caught many global and hedge fund managers off guard, far more than any other year in recent history. Interest rates dropped significantly, contrary to a close-to-consensus opinion last year by 48 of 49 economists interviewed by the Wall Street Journal. China startled the markets when it reported its growth rate fell to levels not seen since the 2008 Great Recession. The resumption of decades-old Cold War tensions with Russia took the world by surprise. And, a price war unfolded in oil, causing more than a 50% decline in oil prices.

US Market Dominance

After two stand-out years for the S&P 500 and Dow Industrial Average, some investors are questioning if US large-cap stocks are the only place to make money. It’s easy to be attracted to recent outperformance, particularly when it is among familiar domestic investments and when broader market performance is so disparate.

In the short-term, SageVest Wealth Management agrees that the fundamentals of our US stock market remain strong. Our economy is one of the healthiest, with strong employment figures and rising consumer confidence. For these reasons, and more, we continue to favor US equities with a distinct overweight to US versus international. However, as long-term investors, we know that momentum can continue to support returns for a while, but that performance will ultimately shift, as it always does. While the US is currently an oasis of growth in the global landscape, this does not mean that we are immune to global impacts, or that investors should abandon international stocks.

Historically, one asset class has seldom remained a top performer for more than two to three years running. If history holds, this means that we are likely approaching a market sector rotation. Valuations suggest that international stocks could be poised for growth. International government stimulus efforts further support such a shift. Additionally, recent return bolstering by a strong US dollar could easily alter course.

Oil And The Global Economy

As we evaluate the US and global investment environments, the price of oil is a high priority consideration. The dramatic decline in oil brings a mix of possible outcomes, depending upon the depth that prices reach and the length that they remain depressed. On a positive note, low oil prices have the potential to provide an economic boost to consumers and energy-dependent businesses such as airlines. They also help to bolster the US dollar, bringing additional assets to the US, and giving another reason to favor US equities in the short-term. However, a prolonged price war poses significant risks. The US energy boom that has contributed to our growth in recent years could face perils if producers can no longer afford to operate. We have already seen initial bankruptcy filings and layoffs in related industries, such as steel pipeline manufacturers. Perhaps of greatest concern is an exacerbation of geopolitical risks as oil-revenue dependent countries such as Russia and Venezuela are facing dramatic economic impacts.

Ultimately, we believe that the price of oil is significantly oversold based upon fundamental drivers of net changes in production and demand. This suggests that we should eventually see stabilization, and higher prices. The primary caveat is that Saudi Arabia has the ability to sustain operations at a profit, even if prices move lower, meaning that this price war could extend longer than market fundamentals might otherwise suggest.

In Summary

SageVest Wealth Management continues to favor US stocks while remaining cognizant of the need to maintain diversification, particularly looking at variables suggesting possible market shifts on the horizon, as well as potential risks. As always, we invite you to CONTACT US with any questions.

If you enjoyed this article, please SUBSCRIBE.