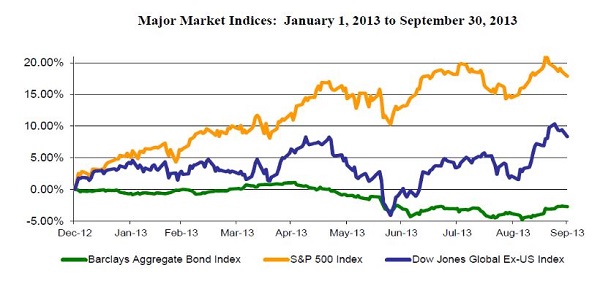

A strong year in the US extended in the third quarter as both the US stock market and household net worth set new all-time highs. Fortunately, the good news didn’t stop there. Previously sluggish international stocks staged a strong rally, climbing a handsome 9.6% for the quarter. Bonds also posted positive returns as interest rate pressures began to subside. It was generally a quarter of good news, with one big zinger at the end: the US government shutdown, which perpetuates as of the writing of this commentary. SageVest Wealth Management explores a number of surprises that emerged in recent months, positive signals looking forward, and a few meaningful short-term risks that the fourth quarter entails.

A Quarter Of Positive Global Economic Surprises

Our last newsletter talked about the divergence in performance between US stocks and other asset classes. A short three months ago, it appeared that only one investment selection of US stocks made sense in 2013, leading some investors to question the merits of diversification. Realistically, it is impossible for economic or stock market growth to remain isolated in one region forever, particularly in today’s highly integrated global environment. The third quarter proved this to be the case. Growth continued at a stable pace domestically, but the real positive ‘surprises’ of the third quarter occurred overseas:

Our last newsletter talked about the divergence in performance between US stocks and other asset classes. A short three months ago, it appeared that only one investment selection of US stocks made sense in 2013, leading some investors to question the merits of diversification. Realistically, it is impossible for economic or stock market growth to remain isolated in one region forever, particularly in today’s highly integrated global environment. The third quarter proved this to be the case. Growth continued at a stable pace domestically, but the real positive ‘surprises’ of the third quarter occurred overseas:

- The Eurozone finally emerged from recession, posting its first quarter of growth after six long quarters of contraction.

- China’s economy showed resilience with strength in exports, industrial production and manufacturing data, allaying prior fears of an economic slowdown.

- China’s growth data lifted other international markets, particularly many of the commodity-rich emerging market countries.

- Japan’s economy is continuing to grow, marking an end to decades of stagnation and deflation.

Both our US economy and the global economy are well positioned to grow further, barring any disruptions, a few potentials of which are discussed in the following pages.

The Fed – Who, What, When, How?

Federal Reserve Chairman, Ben Bernanke, is wrapping up his term with a few surprises of his own. In May, he extended an unprecedented signal that the Fed might begin to ‘taper’ its bond buying program. This would mark a reversal of long-standing monetary stimulus efforts that have supported our recovery.

Follow-through on the May announcement was widely anticipated in September, but the Fed again surprised the markets with no action. In our interpretation, reasons for the reversal in sentiment were generally threefold:

- Rising interest rates that could harm the housing recovery.

- A slowdown in employment growth.

- Upcoming political battles over the budget and debt ceiling that presented significant risks.

Our internal sentiment is that the economy is now strong enough that housing and employment likely could have sustained an incremental shift in Fed policy. However, the Fed certainly did prove correct in its forecast of the Washington political process as the Federal government currently remains shutdown, with less than two weeks to go before we reach the debt ceiling.

Now What?

The surprise September announcement leaves investors guessing when any tapering effects might occur, particularly as Bernanke’s term ends January 31, 2014, with no current named successor. The September meeting opens the door to a number of possible outcomes, including no action for the foreseeable future. Realistically, we anticipate that Bernanke will begin to taper before leaving office, in part to stage the legacy of his most significant initiative in office. The surprise element might be ‘out of the bag’, but a formal call to the end of ‘easy money’ could still rattle the stock and bond markets. Discussion about our thoughts on investment impacts are found below.

The Washington, D.C. Political Mess

We think we can remain politically neutral by simply referring to the current Washington, D.C. political process as a ‘mess’. It is difficult to predict how long the government shutdown will continue, or the outcome once we reach the debt ceiling in less than two weeks. Both political parties appear to be entrenched. While this could lead to a long drawn-out battle, we don’t believe the shutdown will extend beyond a few weeks, simply because of the economic and political pressures it imposes.

The juggernaut is the possibility the shutdown will extend past the debt ceiling limit as a means of political leverage. The good news is that we see limited risk of any actual default in interest payments to creditors, which could have a greater impact than an extended government shutdown.

Short-Term Impacts: Bloomberg estimates that the shutdown is costing at least $300 million per day in lost economic output. Anyone directly impacted is feeling the full brunt of the shutdown. However, on a national basis, this figure is relatively small in comparison to GDP and hopefully will not cause any significant economic or market impacts. This is supported by recent market activity, which thus far has vacillated between up and down days, with surprisingly modest overall impact.

Long-Term Impacts: If the shutdown drags on, the risks become greater. A protracted shutdown could cause a meaningful drag on GDP, possibly stunting future growth potential. The most critical element looking forward is the debt ceiling and continued payment to our creditors. Again, we believe there is a high probability that payments will be completed, but do recognize that extended political uncertainty could eventually impact consumer, business and investor sentiment alike.

Again, we hope the shutdown will be fairly short-lived, and the good news is that recent political history gives evidence of such. That said, the last 1995-1996 shutdown lasted a protracted 21 days. Hence, anything is possible, and it is important to ensure your investments are structured to weather a storm and/or seize possible buying opportunities.

Investment Positioning

As our clients know, we take a long-term investment outlook and maintain diversified portfolios. We also believe in tactical positioning under which we will modestly increase or decrease investment weightings and compositions of assets, relative to our investment outlook. In the current environment, we see long-term interest rate risk in bonds, and possible continued growth opportunities in stocks. Given this outlook, we are pursuing strategies as discussed below, while maintaining overall diversification in an environment where future surprises could generate a mixture of possible outcomes.

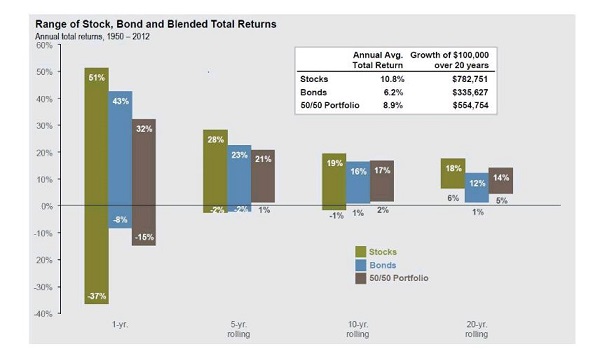

Sources: Barclays Capital, FactSet, Robert Shiller, Stategas/Ibbotson, Federal Reserve, J.P. Morgan Asset Management Returns shown are based on calendar year returns from 1950 to 2012. Growth of $100,000 is based on average total returns from 1950-2012. “Guide to the Markets – US”. Data provided by J.P. Morgan, as of 9/30/13.

The chart above looks at the highest and lowest returns of stocks and bonds over different rolling timeframes. It emphasizes that stocks have historically generated greater returns than bonds, but have also experienced far greater losses. Over the past 52 calendar years, stocks returns have outpaced bonds by approximately 6%. However, stocks also experienced the largest one-year decline of 37% as compared to 8% among bonds. We believe this chart is important in explaining our current strategies.

Bonds could be moving into a difficult performance period. Given this outlook, we have enacted a number of changes, each designed to make overall bond portfolios more defensive. Our objective is to minimize downside exposure by adopting shorter duration strategies, while continuing to capture income yields. We have not abandoned bonds, nor will we, given the important role that they serve, and in recognition that market timing the removal of an asset class can work against you. In fact, the current environment is a case-in-point, as interest rates have substantially subsided in recent weeks.

We remain favorably allocated to equities, and plan to evaluate potential buying opportunities that could surface in the fourth quarter. Stocks have recently pulled back due to government shortcomings, and could experience another pullback when (and if) the Fed enacts a shift in policy. However, we generally expect that long-term impacts could be favorable for equities, particularly while investors continue to seek returns in excess of current bond yields and while global economic indicators remain relatively strong.

As always, we encourage you to CONTACT US with any questions.

If you found this article interesting, please SUBSCRIBE.