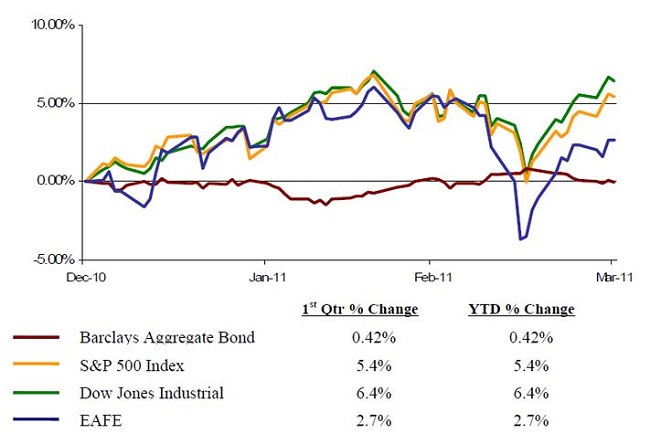

No forecast for 2011 came close to the events unfolding in just the first quarter. Tensions in Tunisia unleashed widespread social unrest throughout North Africa and the Middle East, with ongoing conflict and military action. Catastrophic natural disasters in Japan shifted the earth’s axis and left the world on the edge of a possible nuclear disaster. Coupled with a worsening debt crisis in Europe, you might be surprised by the fact that world markets managed to post positive investment performance.

Major Market Indices: January 1, 2011 to March 31, 2011

Our Domestic Economy

The past quarter proved that investors can climb a wall of worry. Encouraging financial headlines helped to win the tug-of-war between global unrest and domestic economic recovery. Large parts of our economy continued to show signs of strength. The Index of Leading Economic Indicators posted its 8th consecutive monthly gain. Both the service and manufacturing sectors are flourishing. This growth is helping to stimulate long awaited job creation, pulling the unemployment rate down to 8.8%. Government intervention continues to back many of these positive developments.

This is not to say that the U.S. landscape is void of challenges. The weak housing market, government debt levels and rising prices (both consumer and more so producer prices) are distinctive headwinds. All told though, the economic engine of America appears to be running far more smoothly than in recent past.

Japan

The word catastrophe only touches the surface in describing Japan’s 9.0 earthquake, tsunami and nuclear disaster. While we hope that the worst is now behind the citizens of Japan, the process of re-stabilizing and rebuilding has scarcely begun.

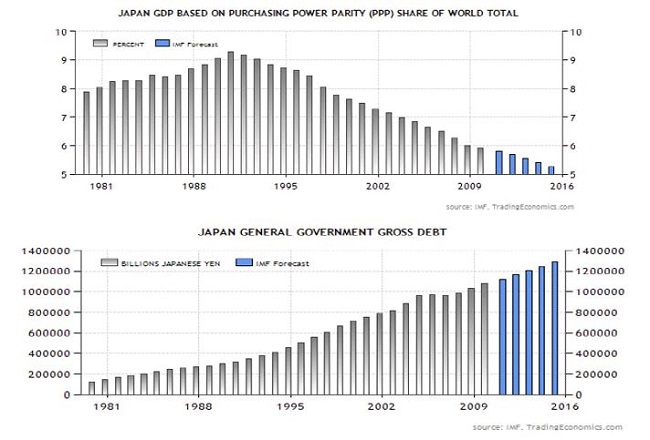

Japan represents the world’s 3rd largest economy, recently losing 2nd position to China. Most of the world has taken a stance that a country of Japan’s stature can afford the costs of rebuilding, much of which it must bear as the country itself insures the vast majority of damaged property (versus third party insurance companies). What complicates this viewpoint is the fact that Japan already holds the highest debt level of any industrialized nation at 225% of GDP (higher than Greece, Ireland or Portugal; and second only in the world to Zimbabwe).

Japan’s debt is a relatively recent phenomenon, spawned by deficit spending to stimulate the economy from the credit crisis of the 1980’s. Unfortunately, Japan’s economy has only contracted as a percent of the world economy while its debt level has ballooned (illustrated in the following charts).

A variable that significantly differentiates Japan from other debtor nations is the bulk of its government debt is financed internally by Japanese citizens rather than international lenders. This fact does not reduce the debt burden, but it does alter the risk profile in contrast to other countries more heavily reliant upon external funding sources.

Growth from Rebuilding

One silver lining that results from catastrophes is a rebuilding process that can stimulate economic activity. Japan’s industries stand to benefit from rebuilding demand, as well as other countries that will supply materials, equipment, technology, etc. The critical test will be if the growth in economic development will be enough to offset the additional debt burden, and likely higher tax burden, that the Japanese government, citizens and businesses will have to assume. We fully believe the Japanese will remain committed to rebuilding both their infrastructure and their economy as the resilience of their population is virtually unparalleled.

North Africa And The Middle East

It is not surprising that revolts finally erupted throughout North Africa and the Middle East, particularly if you consider that rising food prices equated monthly wages for many Egyptians to the cost of a loaf of bread. What is surprising is how quickly unrest spread throughout the region. Oil prices promptly rose, topping $100 per barrel for the first time since October 2008. The prospects of extended instability in the region are undoubtedly high given the number of countries involved and level of changes occurring. This means that oil prices could remain elevated for a period of time.

It is important to recognize that the risk of supply disruptions (rather than actual disruptions) is pushing oil prices higher. Yes, disruptions have occurred in Libya, but Saudi Arabia has stated a willingness to ramp up oil production. Our eyes remain focused on Saudi Arabia – the king pin in the region. Tensions have moved closer to its borders in Yemen and Bahrain, but thus far things remain calm in the Saudi Kingdom – a calmness that we hope continues for the benefit of the world economy.

Europe

To be blunt, Europe benefited by the fact that headlines of additional debt problems were overshadowed by news from Japan, North Africa and the Middle East. Portugal became the latest nation forced to request a debt bailout, which could total $129 Billion. The good news is that austerity measures in Spain could avert a much larger bailout. If Spain succeeds, current EU reserves should be adequate to address the needs of weaker countries. That said, existing debt bailouts, credit downgrades, resulting impacts on bank balance sheets, austerity measures and rising inflation are hampering growth throughout Europe, the effects of which are likely to linger for quite some time.

Looking Forward

Results of the next few months will be critical in evaluating economic and market resilience as we receive reports that reflect performance during recent turbulent periods, as international events continue to unfold and as the Fed’s QE2 program draws to a close in June.

Recognizing the challenges throughout the global investment landscape, SageVest Wealth Management elected to converge our international holdings among actively managed investments. We feel it is more important than ever to have a manager at the helm, critically assessing the impacts of supply disruptions in Japan, the political environment in North Africa and the Middle East and government debt concerns throughout Europe.

From a broad positioning standpoint, we remain more bullish among domestic and emerging market equities. Yes, political battles are brewing in the U.S., but they pale in comparison to what we see internationally. We also feel that additional wealth creation potential remains strong among emerging markets.

As always, we invite you to contact us to discuss these thoughts and your investments in greater detail.

If you found this article insightful, please SUBSCRIBE.