March is Women’s History Month, making it a perfect time to highlight women’s many achievements since women first gained the right to vote, less than one hundred years ago. Today, women comprise 47% of the workforce, occupy 20% of U.S. Congressional seats, and more women under age 29 obtain undergraduate diplomas compared to men.

However, while there’s much to celebrate about women’s empowerment, there’s still a long road ahead to accomplishing true equality for women: personally, professionally, and financially. SageVest Wealth Management takes a look at some interesting statistics about women today, and consider ways to secure your financial future as a woman.

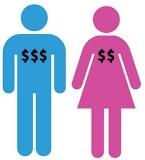

More Than 40% Of Mothers Are Breadwinners [1] — Yet Women Still Face A 22% Earnings Gap [2].

More Than 40% Of Mothers Are Breadwinners [1] — Yet Women Still Face A 22% Earnings Gap [2].

A statistic you might find surprising is that more than 40% of mothers are breadwinners, generating at least half of all family earnings. Women have been steadily increasing their role as contributors to their family’s finances, yet on average, they still earn 22% less than their male counterparts. This means that many families, especially those led by single mothers, often fall short of where they should be financially.

Don’t ever sell yourself short. Research comparable pay scales in your geographic region, then negotiate pay raises based upon performance, experience, tenure, and education. Ask for what you’re worth, and take action to address gender differences in compensation.

While growth among female breadwinners is impressive, it also presents a dichotomy to traditional earning relationships, potentially triggering stress for you, your partner, and your relationship. Our article, Ten Relationship Tips For Women, looks at how you can adapt your personal relationships to meet these new challenges.

More Young Women Obtain College Diplomas Vs. Men [3] — But Are More Apt To Enter Lower Paying Careers [3]

More Young Women Obtain College Diplomas Vs. Men [3] — But Are More Apt To Enter Lower Paying Careers [3]

Today, more women under age 29 obtain undergraduate degrees and certifications than men. Yet women still tend to pursue lower paying jobs in fields such as health and education e.g., speech pathologists, dental assistants, and social workers [3].

While pursuing your passion through your work encourages a sense of personal achievement and self-fulfillment, it’s important to recognize earning discrepancies across professions, and in particular, the potential impact upon your personal and family financial planning.

Women Are 14% More Likely To Save [4] — But Their Average Retirement Balances Are 35% Lower [4].

Women Are 14% More Likely To Save [4] — But Their Average Retirement Balances Are 35% Lower [4].

Women are frequently cast as financial under-achievers and overspenders. However, a number of studies show that women often outperform men when it comes to investing. Furthermore, a recent Vanguard study showed that women are 14% more likely to voluntarily contribute to employer 401(k) accounts. Nonetheless, the average woman’s retirement account balance was only $79,572 vs. $123,262 for men [4]. This discrepancy is largely attributable to two key factors:

- On average, men earn more.

- Women more frequently experience employment gaps to care for children and other family members.

These variables, compounded with longer female lifespans and lower Social Security retirement benefits later in life, require you to be far more diligent about accumulating wealth and protecting yourself financially in the future, including in retirement. Read our 5 Money Tips For Women for more information.

70% Of Women With Children Participate In The Workforce [2] — And Women Are Twice As Likely To Care For Aging Parents [5].

70% Of Women With Children Participate In The Workforce [2] — And Women Are Twice As Likely To Care For Aging Parents [5].

If you’re like most mothers today, you’re probably a working mother, juggling career and family responsibilities. Women are also twice as likely to become caregivers to other family members too [5].

While you may decide to take time off for important family care needs, make sure you understand the financial impacts of being a stay-at-home mother or caregiver. Consider this calculator to estimate the true cost of lost employment.

23% Of Families Were Headed By Single Women In 2016 [6] — Up From 8% In 1960 [6].

23% Of Families Were Headed By Single Women In 2016 [6] — Up From 8% In 1960 [6].

More women today are raising families alone, due to divorce, death, or simply by choice. Whatever the reason, single motherhood requires you to be even more financially savvy, for your benefit and for your kids. You need to be focused on providing for your family’s needs today, saving for college, saving for retirement, and protecting yourself and your kids from life’s risks. Check out our Quick Review Financial Planning Checklist for a list of essential planning considerations.

SageVest Wealth Management is a top-ranked, woman-owned firm, founded and run by Jennifer Myers, a single working mother of two. We distinctly understand the importance of women’s financial equality, financial knowledge, and financial empowerment. We provide comprehensive wealth management services, including investment management and financial planning services, designed to simply your life and encourage wise financial decisions. We also place a special emphasis on family considerations, and offer our sister site, SageVest Kids, as a robust resource to help educate the next generation about money management. Please contact us to learn how we can help.

REFERENCES

[2] https://www.dol.gov/wb/stats/stats_data.htm

[3] https://blog.dol.gov/2017/03/01/12-stats-about-working-women

[4] https://www.cnbc.com/2016/02/25/women-save-more-than-men-for-retirement-study.html

[5] https://www.caregiver.org/women-and-caregiving-facts-and-figures

[6] https://www.census.gov/newsroom/press-releases/2016/cb16-192.html