Young individuals are frequently filled with the excitement of making an impact, becoming more independent, and enjoying life. Frequently, the last thing they are thinking about is planning for retirement. However, though retirement may be decades away, a few small steps at a young age can lead to better financial security throughout life.

One of the best reasons to start planning early for retirement is the concept of compound growth. Although most younger workers feel like there’s not enough money left over to invest in a retirement fund each month, even small contributions start adding up and have the potential to grow exponentially by the time retirement enters the picture.

How Compound Growth Works

A steady contribution of $100 a month to a retirement fund starting at 22 years old could amount to $380,000 by age 67, assuming a 7% average annual return over that period. The $100 per month contributions over this timeframe would total $54,000 versus the potential of $380,000. The difference is attributable to the power of compound investment earnings.

Small amounts continue to grow along with the additional contributions because of compound growth. And if contributions are incrementally increased as income grows, a saver can be well-positioned for a comfortable retirement.

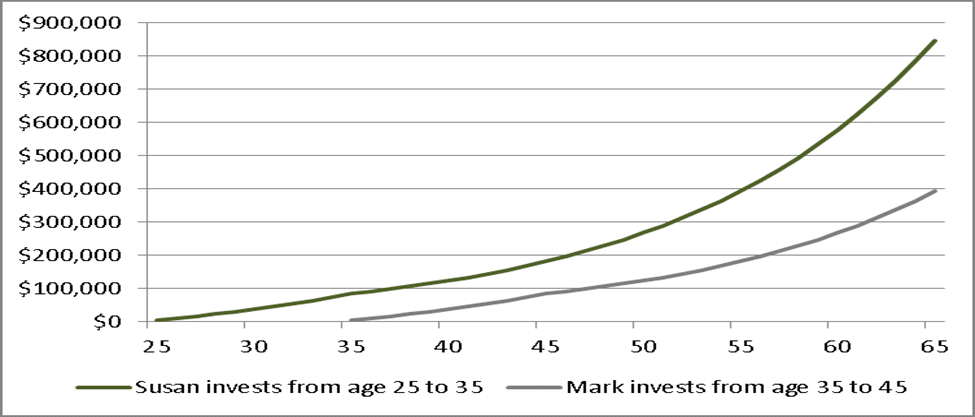

The chart below shows that if $5,000 is invested each year with an 8% return it would be worth $846,179 if started at age 25. However, if this same level of savings is deferred to begin at age 35, just ten years later, it might only be worth $391,945. That’s a significant difference long-term.

Where Will the Money Come From?

It’s normal to feel cash-strapped when in the early stages of a career. However, there is more flexibility in lifestyle and financial responsibilities. In the absence of kids and mortgages, individuals have greater control over spending and saving. Carving out just $100 a month, or $25 a week, for a retirement plan contribution does not cause much sacrifice when spending is more flexible.

Take advantage of this period of life by thinking about how to prioritize spending and saving. Consider small changes such as cancelling one subscription service or cutting out one restaurant meal a week. Then stick that extra cash into a retirement plan. As noted above, even an extra $100 a month now can snowball into a significant sum.

Automate for Ease and Diligence

The best way to get started on your savings path is to automate savings on a monthly basis. This can be achieved by setting up recurring contributions to your employer retirement plan, a Roth or traditional IRA, or a dedicated savings account.

If you have an employer retirement plan, the benefit of gaining an employer matching contribution is powerful. Matching contributions effectively provide an immediate return on your investment by gaining extra savings funded by your employer.

The Added Benefit of Tax Savings

When saving in a tax-deferred retirement plan, this reduces current income that is subject to taxes. The strategy creates a lower tax bill to help put more money toward either expenses or to fund savings. For example, that $100 a month, or $1,200 a year, for someone in the 22% tax bracket reduces your taxes by $264 a year. Said another way, the cashflow impact of saving $1,200 is only $936 due to the tax savings. For now, that’s extra money to add to the annual budget.

The Benefit of Long-Term Investing

Saving in a fund of diversified stocks offers more potential for higher long-term returns. And if there is a dip in the stock market, there is plenty of time to make up for losses as a longer time horizon increases the ability to recover losses once the markets bounce back.

The best part of saving early and staying invested long-term is reducing the need to play catch-up later in life. That $100 a month starting at age 22 would likely need to be at least $500 a month to reach the same amount if starting at age 42.

Starting and Tracking Savings Is Easier

Access to investing has exploded in recent years. Take advantage of easy, inexpensive ways to jump-start retirement planning. Mobile apps automatically transfer small amounts of cash into a non-employer retirement plan such as an IRA and monitor contributions and investments. Spending alerts provide notice to stay on a spending plan to allow an excess amount for contributions, get instant balance notifications and more.

The SageVest team believes we play an important role in helping the next generation successfully launch. Getting a jump start on saving and investing sets the groundwork for long-term financial success. Please contact us to learn how we can help you achieve financial freedom.