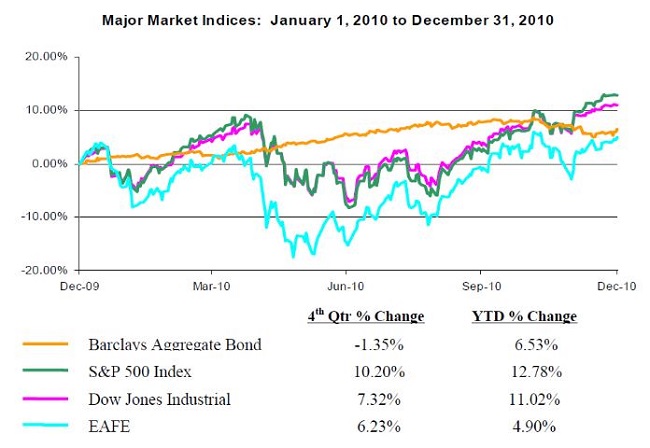

What amounted to be a choppy year fortunately finished with investor holiday cheer. Investment markets posted positive across-the-board returns among equities, bonds, real estate and commodities, rewarding those who held confidence throughout a number of challenges such as the BP oil spill, the May 6th Flash Crash, a mortgage foreclosure debacle, political turmoil and the continuing European debt crisis. All in all, a second year of recovery has further strengthened the economy and allowed many investors to regain financial stability, offering a strong start and outlook as we move into 2011.

An Economy On The Mend

Economic improvements remain more tepid than most would prefer, but they are real and are continuing to take hold. This is particularly the case in the private sector where we see leading economic indicators accelerating; jobs growing, commercial credit conditions improving, merger and acquisition activity picking up; consumer spending resuming, inflation remaining in-check, and businesses with healthy balance sheets and growing earnings. The economy is mending.

Government interventions have fostered recovery, and recent additional stimulative actions (extended tax relief, new tax cuts and a second round of quantitative easing) further fuel short-term upside potential. As investors and financial advisors, we look forward to 2011 with an objective of capturing this upside while also keeping a close eye on the long-term – a primary topic of discussion in this newsletter.

Government Spending: Long-Term Problems On The Horizon

Growth requires investment – a simple fact. However, wise investment decisions also evaluate growth potential in relation to capital outlays and associated risks. While governments are not businesses, they are required to assess long-term implications of spending and fiscal decisions. The simple reality is that our federal government is spending far more than the revenue it is generating.

Deficits are nothing new in our country’s history. In fact, the federal government has operated deficits in all but 8 years since 1930. What is alarming about today’s deficit is its magnitude relative to current revenues, obligated expenditures and future revenue potential. Current federal expenditures total almost 150% of revenues. Of these expenditures, mandatory items such as Social Security, Medicare, Medicaid and interest payments on the national debt consume the bulk of revenues (approximately 70%). Each of these mandatory expenditures is anticipated to increase as the baby boom generation enters retirement and as interest rates begin to climb. Hence, while people call for rational reductions in discretionary spending, the reality is that such cuts are not enough without dramatically slashing or potentially eliminating defense, education, transportation and other critical areas. And, while economic growth will help to increase tax revenues, the additional reality is that the U.S., as a developed country, is typically gleeful to achieve 3% annual GDP growth – far less than what is necessary to bridge the deficit gap.

Radical and difficult changes will ultimately be required to solve our national debt problem. Many states are now facing these challenges as they do not have the ability to run deficits or print money. As we look forward in our investment strategies, we do not take political sides, but we must be realistic about the impacts these deficits bring.

Eventually, we don’t see any solution that does not entail reductions in government spending, which supports a significant part of our overall economy (estimated between 30% to 40% of GDP including federal, state and local government expenditures). We also foresee an eventual requirement to increase taxes. These initiatives combined, known as austerity measures (taxing more and spending less), are exactly what European governments are currently imposing to address the European debt crisis.

SageVest Wealth Management reduced exposure to European markets throughout 2010 because of the short-term economic contraction that austerity measures create. Future reductions in U.S. market exposure are likely to occur among our portfolios, although not at the immediate time. Our rationale, as previously stated, is that we see short-term growth potential in our domestic markets while government spending and support remains strong (albeit reckless). Simply stated, as citizens, we criticize government decisions to tax less and spend more. However, as investors, we want to capture the short-term benefits available to our clients while keeping sight of longer term ramifications. We hope that politicians (on both sides of the aisle) find the fortitude to look beyond short-term elections to help our country regain its long-term financial strength. In the interim, we caution everyone to take heed of the changes that we foresee for our country and our economy.

Bond Repositioning – Transitioning Long To Short & Pulling In The Reigns

One immediate change that we have begun to initiate throughout portfolios is a structural change in our bond holdings. Bonds are owned for two primary purposes – income and capital preservation. Rising interest rates and a possible flight from government bonds (for fiscal reasons discussed) could pose dilution of principal among bond holdings as interest rates and bond prices move in inverse directions. Higher interest rates make bonds more attractive to purchase, but they diminish from the value of bonds already owned.

SageVest Wealth Management is not abandoning bonds as they serve a critical role in portfolios. However, we are actively shortening the duration of bonds (to reduce interest rate risk), diversifying the types of bonds and bringing bonds closer to minimum investment thresholds under individualized Investment Policy mandates.

To the extent that we are reducing bond exposure, we are redirecting assets across a number of assets, all intended to generate net returns while reducing overall portfolio risk. Alternative assets were expanded earlier this year to offer greater investment diversification outside of traditional equity and bonds markets. A variety of investment strategies are employed under the realm of alternative assets and we recently further expanded these positions. To a lesser degree, additional investments are being allocated to dividend paying consumer staple stocks, real estate and tactical global asset managers.

Long-Term Investment Principles – Still Intact

In discussing these changes with clients, a few individuals have asked if we are moving into a new era of investment principles. We could be embarking upon a shift in market direction, but SageVest Wealth Management firmly believes that the basics of strong investment strategies remain intact – focusing on investments with solid financial fundamentals. Long-term investment growth is seldom achieved in a straight trajectory or by single stock picking glories. Rather, it requires discipline, diligence, sometimes courage and a keen eye on economic and investment fundamentals. We remain committed to following these principles which we still see as key to long-term success.

As always, we invite you to contact us to discuss these thoughts and your investments in greater detail.

If you found this article insightful, please SUBSCRIBE.