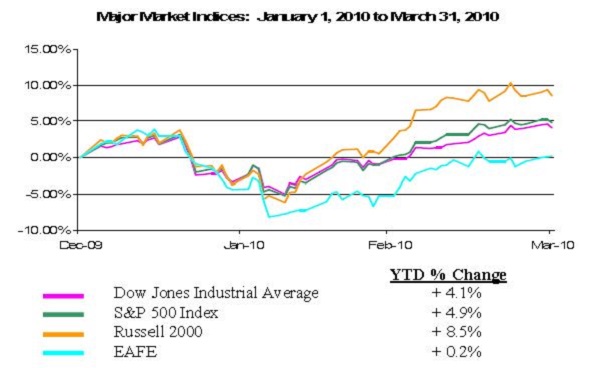

World equity markets started the year with gusto carried over from 2009, but were quickly set back when the Greek debt crisis surfaced. Investors are still trying to determine the short and long-term impacts of mounting Greek debt and around the world. These concerns did not prove significant enough to halt the recovery process. The balance of the quarter offered steady, strong results that brought domestic equities back into positive territory and allowed international equities to end the quarter essentially flat.

What Are We Seeing In The “Show Me” Year?

Our commentary at the beginning of the year suggested that just like Missouri is known as the “Show Me” state, 2010 is likely going to be the “Show Me” year. Investors will be looking to see if stimulus efforts and returned economic stability translate into actual job creation, higher corporate revenues and an improved housing market. Sure enough, early indicators seen last year are developing into solid results.

The recovery is growing sturdier as improvements expand beyond investment markets to real market fundamentals. After 18 months of negative reports, positive indicators began to surface late last year and are becoming more prevalent to the point of gaining predominance. Virtually every segment of our domestic economy has shifted into gear, with the most important improvement recently hitting the headlines:

Jobs!

March rendered our first strong jobs report with the creation of 162,000 non-farm payrolls. We still have a long journey ahead of us to recover the 8.4 million jobs lost, but we see the necessary fundamentals in place: business confidence and broad economic demand.

Businesses operated at incredibly lean levels throughout the recession. Falling revenues coupled with an inability to obtain debt financing left companies cash strapped and forced to cut expenses, including millions of jobs. While business spending only represents 30% of our domestic economy, the important fact is that businesses employ the vast majority of the population – the critical consumer base.

As signs of recovery began to surface, businesses became more confident and willing to make financial commitments with one notable exception – hiring. Merger and acquisition activity renewed late last year as companies saw opportunities to acquire at depressed (opportunistic) levels. Capital investments in technology have been significant, both to update systems and enhance productivity. Research and development efforts are back on track so that companies remain competitive. Inventory levels have been replenished, restocking shelves for current and future demand.

The level of economic improvement that has ensued leaves businesses with little choice but to expand payrolls. Increased sales and growth bring additional, unrealistic workloads to existing employees who are already operating at unsustainable productivity levels. If businesses expect to meet growing demand, they will need to grow their workforces. The first signs of job creation began in the 4th quarter of 2009 when businesses began to ramp up temporary help services. More recently, many employers added more hours to employee work weeks, pulling the national average off a low of 33 hours per week. Now, we are finally seeing companies turn the critical corner by making commitments to new permanent hires.

Improvement in the employment markets will take time and might not offer the rapid fire economic results that we have seen to date. On the flip side, job creation is the critical catalyst that offers long-term sustainable growth opportunity.

Broad Based Participation

Economies as a whole are showing improvement. In the U.S., our service sector grew for the 3rd consecutive month in March and our manufacturing sector posted its best reading since 2004. Looking deeper, virtually every market sector (health care, technology, consumer goods, durables, etc.) participated. Also important is the fact that growth is not limited to our domestic markets. Economies around the globe are seeing strong improvements – so strong in some areas that countries such as China are purposely trying to slow growth and others are combating inflation spawned by the rapid recoveries.

As SageVest Wealth Management looks forward, some factors that have generated quick economic results could begin to fizzle. Examples include recent inventory rebuilding and pent-up consumer spending. This leaves us to question if recent growth can be sustained. We believe that broad market participation (rather than seeing growth in isolated areas) is a positive indicator that growth will continue.

While a modest pullback would not be surprising, the fact that growth has been so broad gives encouragement that some level of growth will continue, and likely enough to spur more job creation.

Government Stimulus

Broad based economic participation is also vital to our ability to sustain growth as we transition away from government stimulus and incentives which have been so important to the recovery. Abundant amounts of stimulus money are still available, but programs such as Cash for Clunkers came and went, and critical programs supporting the housing market either have or are about to draw to a close.

The Federal Reserve Board’s mortgage backed securities purchase program ended on March 31st and home buyer tax credits are scheduled to end on April 30th. These programs helped to reduce mortgage borrowing costs and provide incentives for new home purchases. The housing market collapse that spawned the recession has shown signs of recovery, but recovery has been modest at best. Mortgage rates have already slightly increased since March 31st (when the Fed’s program ended), drawing question as to what level of future recovery is sustainable without government support. The next few months will be critical to this assessment.

The Long Term Costs

One of the greatest long-term risks that we see to the global economic recovery is mounting government debt obligations. If economies continue to grow, tax revenues should also grow, helping to reduce debt balances. However, the time gap between now and when baby-boomers begin to draw upon Social Security and Medicare (and other programs overseas) is narrowing, bringing escalating costs closer to the present. (Currently, Social Security and Medicare represent 39% of our Federal budget, before the first baby-boomer turns 65 in 2011.)

Beyond the sheer volume of debt that we and other countries hold, what concerns us is the fact that the bulk of our U.S. debt is financed through short-term Treasury obligations. These obligations must be refinanced upon maturity at prevailing market rates. This isn’t a problem if rates remain low, but if demand for Treasury bonds falters, rates will be forced higher to solicit enough buyer intrigue. This is one distinct scenario that could drive rates higher in the absence of inflation.

The potential of higher Treasury rates poses risks to the government and to the broader economy as higher rates would ripple through other lending markets – almost certainly driving up the costs of mortgages, auto loans, commercial loans, corporate debt, etc. A strong economy could likely withstand higher rates, but a recovering economy could easily be derailed.

SageVest Wealth Management maintains watchful eyes on areas of perceived risk, but just as much on the abundance of positive signs that we see in today’s market. Virtually every indicator suggests that growth will continue for the foreseeable future given the breadth of the recovery, low interest rates and the level of government stimulus remaining in effect.

Our advisors conduct active and ongoing investment due diligence on your behalf, which is then applied to your personal portfolio. If you are interested in learning more, please contact us.

If you found this article interesting, please SUBSCRIBE.