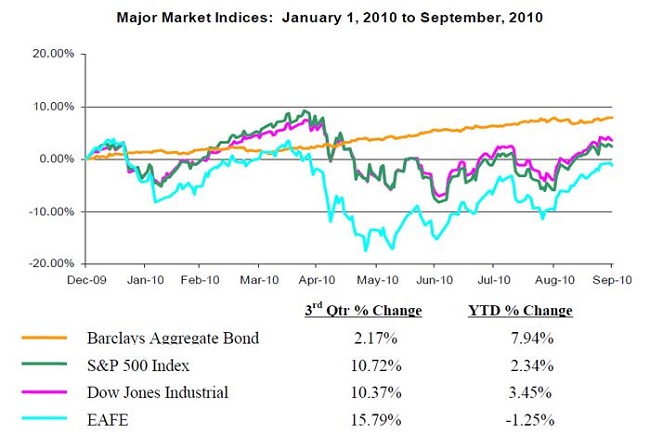

After a difficult start, the third quarter ended with a red-hot rally, bringing a much needed ‘Indian Summer’ effect to the markets. Equities significantly outpaced bonds for the month of September. This was an anomaly as September is one of the worst performing months by historical standards, and a reminder of how trying to time the markets based on trends can easily backfire. Year-to-date, bonds remain primary contributors to bottom line returns as the economy desperately tries to regain recovery momentum.

A Transitional Market

As stated in SageVest Wealth Management’s last newsletter, slow or stunted growth does not necessarily equate to negative growth. We remain in an environment where consumers, businesses and the government alike are trying to discern the difference and what our economy has to offer. The result is that we remain in a transitional market in which sentiment shifts between optimism and pessimism, and in which the market pushes forward and pulls back. In such an environment, investors question if we are ‘trading range bound’.

Technically, we achieved economic expansion in the second quarter. This is a positive indicator that the recovery remains intact. However, this is one of the more muted recoveries in history following one of the most dramatic contractions in decades. A strong recovery is required to bring our economy and our markets back to parity. While institutional investors are favoring equities, individual investors continue flocking to bonds – creating a ‘tug of war’ in the markets.

Corporate Balance Sheets – Filled With Cash!

A very encouraging sign is that companies are sitting on incredibly high cash balances. This is positive to the extent that companies are financially stable and in strong posture to avoid a repeated corporate domino collapse. However, it is also frustrating as we need companies to deploy cash balances to stimulate growth.

As of June 30 (the most recent data available), industrial companies in the S&P 500 index held a record $843 Billion in cash on their balance sheets. Looking more broadly across all non-financial S&P 500 companies, this figure juts up to an estimated $2 Trillion. While companies (and individuals) should always have cash on hand, such balances broach the threshold of ‘hoarding’.

Companies have different options of how to deploy cash – buying back stock (strong during 2008 & 2009), engaging in mergers and acquisitions (resuming, but tepid), issuing dividends (on the rise) or reinvesting in growth (limited and what we need).

The primary focus that we currently see among companies is the issuance of dividends. A recent and significant example is Cisco (a large technology, growth-oriented company) initiating dividend payments. Dividends benefit shareowners, but they also remove cash that could be utilized for capital improvements, research and development, and hiring – all of the things we need to stimulate the economy. While we would prefer investments in growth over dividend payments, the commitment to pay dividends at least signals corporate confidence and a willingness to release cash. It offers hope that such confidence could extend and unleash business spending on growth strategies.

Why Is Cash Staying On The Sidelines?

As we monitor corporate cash balances and opportunities therein, we also have to assess why companies are hesitant to spend. Part of the answer is a classic Catch-22 scenario. Companies want to see stronger growth before they commit resources, but the economy needs companies to deploy cash to stimulate the growth they are seeking. Result: stalemate.

The other explanation is uncertainty, which is plentiful and creating investor hesitation.

- Unemployment remains stubbornly high.

- The housing market remains troubled, despite record low mortgage rates.

- All eyes are on the mid-term elections – will we have a shift in control?

- Will taxes increase, only for the wealthy or not at all?

- Budget deficits are unsustainable, yet growing.

- Ireland’s debt is contained for the moment, but presents real risks of a European debt crisis relapse as bank bailout costs could reach 1/3 of the country’s GDP.

Ironically, aggressive borrowing by businesses and individuals prompted the financial meltdown, and now, uncertainty about excessive debt held by our federal, state and other sovereign governments is creating angst among businesses and individuals. We wish we had the answer to government debt problems, but we do know one thing for certain – the current math doesn’t add up. The last time our country held debt of this magnitude was post World War II when the baby boom generation was being born, at the onset of industrial expansion, and when the top marginal tax rate was 91%. Today, that baby boom generation is preparing to retire, we face massive social obligations and tax rates are at historic lows. We either have to cut spending or increase taxes. Individuals and businesses who understand this factor it into their decision making.

Eyes On The Fed

Oscillating directional forces by the Federal Reserve Board (Fed) could further feed uncertainty or be a sign of new growth. In March 2009, the Fed initiated massive quantitative easing (printing money to buy government and mortgage-backed securities), infusing well over a trillion dollars into the economy. A year later, the Fed formally ceased the purchase of mortgage-backed securities in response to signs of improvement and stabilization. Now, only 6 months later, the Fed states that it stands ready and willing to resume quantitative easing. Why this flip-flop? Although we generally observe the Fed working to curtail inflation, we now watch as they try to stimulate inflation in order to combat stagnation or worse yet, deflation.

The last time the Fed initiated quantitative easing, the markets soared. Perhaps a second act will follow. Pulling out the ‘big guns’ twice could also make people wary. The real question is will it generate results? The Fed can infuse all the money it wants, but at the end of the day, we need banks to lend and companies to spend.

Posturing In Uncertain Times

Our economic environment remains fragile with a host of plausible outcomes. The recovery could regain momentum, we could remain in a stalemate posture, or a double-dip recession could ensue. SageVest Wealth Management believes recovery potential still exists and are attracted to equities in this environment. At the same time, we are keenly aware of our clients’ objectives to both grow and preserve the wealth they have accumulated. We therefore maintain meaningful exposure to bonds (typical capital preservation assets), but have also broadened our stance by incorporating a larger and deeper mix of ‘alternative assets’. New positions seek a multitude of strategies (managed futures, convertible bond arbitrage, covered calls, long-short, etc.) with an ultimate objective of generating returns without tracking equity or bond market performance. During this period of uncertainty and facing a market that could remain in transition, these strategies are introduced to achieve our overarching objective – to enhance risk adjusted returns.

As always, we invite you to contact us to discuss these thoughts and your investments in greater detail.

If you found this article interesting, please SUBSCRIBE.