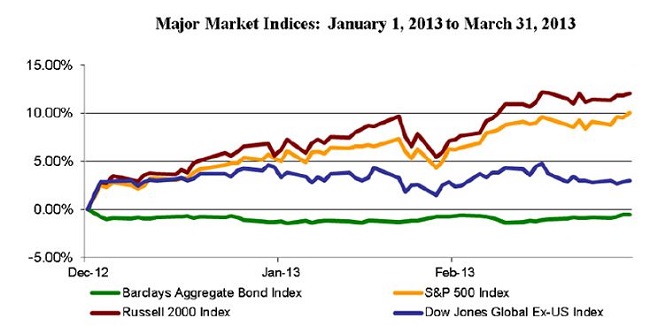

The S&P 500 and Dow Industrial Average indices posted fresh all-time records in the first quarter, as both indices boasted double digit returns in just a short three months. US stocks were ‘the place to be’, while many other investment areas were far more muted. The international equity markets offered a modest 3% return, with Japan as the big winner and emerging markets (primarily Brazil) as the laggard. The aggregate bond market was slightly negative as interest rates moved higher. Commodities were mixed, but slightly negative; in large part due to a pull back in gold. Overall, it was a rewarding first quarter, but with wide variations in performance among various types of investments.

Up, Up And Away?

Since November of last year, the US stock market has been almost impenetrable. It weathered the fiscal cliff, a negative GDP report, sequestration, higher payroll and income taxes and a crisis in Europe without experiencing any meaningful pullbacks. This is a marked shift in comparison to the past several years, when negative news quickly pulled the markets from peaks to valleys. Such a shift begs the question: “Is the recent resilience sustainable?”

While there are no crystal balls, there are two historical insights to offer. First, every year in which the Dow has registered an 8% return or higher in the first quarter, it experienced a positive return for the year as a whole (although not always maintaining first quarter returns). This bodes well for 2013 if history repeats itself. That said, investors should develop realistic expectations. Continued performance at the same pace of first quarter results would be an incredibly lofty feat. In fact, the Dow has only managed to achieve such an extrapolated return in one single year, looking back to 1929.

Rather than looking to history, SageVest Wealth Management believes it is more important to examine the variables that are driving our US markets. These primarily include improving economic fundamentals, reduced fiscal uncertainty, continued Fed stimulus and a surge in retail investor interest. Some of these drivers are encouraging, while others give us pause as we look forward.

US Market Drivers

Improving Economic Fundamentals

Many areas of our economy are improving, namely the ever important housing market, which significantly impacts the broader economy. Consumers have remained resilient in spite of the recent 2% payroll tax increase, and businesses are increasing spending alike. Energy development in the US has been transformational, offering a much brighter future for potential energy independence and growth from that sector.

While things are improving, the pace of growth is still a concern. GDP growth remains persistently below 3% and substantially below our economic potential. Hence improvements are welcome and encouraging, but we still have a way to go before our economy can operate without Fed support (discussed below).

Reduced Fiscal Uncertainty

We finally removed some layers of political uncertainty which have constrained spending for some time, particularly among businesses. The political process wasn’t exemplary and many things remain unresolved, but we have made some progress and thankfully without theatrics. Most important, we have a greater sense of known fiscal elements which allow individuals and businesses to plan and take action, potentially adding to future economic activity.

While there are long-term benefits associated with gaining clarification, we could face some modest pullbacks as sequestration goes into effect. The real impacts of the March 1st deadline are just about to begin as spending cuts transform into real life events. Reductions in government spending will create a negative drag on the economy, particularly in the DC metropolitan area. However, we expect the impacts

to be fairly modest on a national scale. Perhaps one way to put sequestration into context is that the $85 billion of total spending cuts that it entails is the same amount that the Federal Reserve is pumping into our economy every month.

Continued Fed Stimulus

That brings us to the big elephant – the continuation of the Fed’s quantitative easing program which pumps over $1 trillion into the markets per year. That’s not a number to sneeze at as it represents almost 7% of our annual GDP. We don’t foresee any short-term deviation in the Fed’s program, which is good news for the US stock market, but discussions about a future shift in policy are increasingly prevalent. It is widely considered that the Fed has been the leading contributor to recovery since 2009. As such, any future reductions in Fed stimulus will impose a real test on the economy and the stock market, perhaps well in advance of any action if anticipation begins to build. Fortunately, recent Fed considerations include staged reductions, which could temper risks.

Again, we do not foresee the Fed altering its policy in the short-term, but this is a key variable that we are carefully monitoring. In the meantime, hot money off the printing press here domestically by the Fed and internationally by other central banks could continue to fuel the stock markets.

Surge In Retail Investor Interest

There has been an ongoing shift of retail investor interest in the stock market as the markets have recovered. This interest was slow to build after the depth of stock declines through March 2009, when investors fled the markets. Many individuals wanted to see the stock market regain stable footing before buying back into equities. For many, this means they missed out on significant early gains. As the stock market has regained strength, bond and CD yields have dropped to ultra low levels, leaving conservative investors in a quandary of how to at least achieve enough yield to keep pace with inflation. A number of these investors are now flocking back to the stock market in pursuit of return. This is in part what has fueled recent stock market recovery.

A rekindling of retail investor interest could continue to drive the markets higher due to sheer demand. However, we take note of the fact that similar past events have at times signaled that the end of a cycle is drawing near.

Synopsis

All-in-all, a number of positive elements could continue to support further stock market advancements. At the same time, we are hesitant to assume that the market is impenetrable due to a number of variables, namely the outlook for Fed stimulus programs and the underpinnings of real economic advancements achieved before any such monetary changes take effect.

New Precedent In Europe?

Europe has been and likely will continue to be a classic case of taking two steps forward and one step back (or at times, one step forward and two steps back). European stocks as a whole enjoyed positive returns in the first quarter, despite taking two steps back. In February, Italy failed to form a government collation, leaving the country in a state of political unrest. However, the biggest event was in the much smaller country of Cyprus, where bank bailout remedies might have set a new precedent for Europe.

Cyprus is a small country with only 800,000 citizens, but with a large banking sector that measures about eight times the country’s economic output. The multi-billion dollar banking bailout package finally agreed to includes levies on private bank accounts with balances in excess of the guaranteed insured amount of €100,000. This means that for the first time, individuals, companies and organizations outside of the public sector are being forced to help pay for a funding solution. This change in approach potentially increases the chance of a run-on-the-banks when and if other countries are forced to request bailouts. This is an interesting twist to be mindful of as we look ahead.

In the meantime, austerity continues to weigh on European economies, but things are gradually improving, which is still a step forward.

Broader World Demand

The broader world markets included a wide range in first quarter performance, with some significant shifts in country performance relative to recent history. The 20-year beleaguered Japanese market has suddenly topped the performance charts, while growth areas like the emerging markets have lost ground.

Japan

We wish we could report recent stock market performance to be the result of a rebounding economy, although that is the hope! Japan’s central bank recently announced aggressive quantitative easing actions (similar to those of our Fed) with an aim to jumpstart the economy and reverse persistent deflation. Time will tell if new government stimulus (which in part triggered the current decline 20 years ago) can translate into economic activity after such an extended period. In the short-term, one thing is for sure – quantitative easing is helping stock investors to rejoice.

Emerging Markets

Emerging market stocks were mixed in the first quarter, although down on the aggregate. Two big disappointments were from countries that have historically provided handsome returns: Brazil and China. Weakness in China’s economy had ripple effects, namely to Brazil, as demand for commodities and industrial materials contracted. Data from China is improving, although material stockpiles remain higher (signaling possible further delay in demand).

The future outlook for China is meaningful as it represents the second largest economy in the world (second to the US). Its protracted real estate bubble, and the fact that jobs are moving to cheaper labor markets certainly raise a few red flags. However, its economy has remained rather resilient and we believe that current economic and fiscal actions have the potential to allow long-term growth to continue.

Investing Going Forward

Looking forward, the 2013 stock market rally could easily persist as economic growth (albeit sluggish growth) is seen throughout much of the world. Central banks are also continuing and expanding stimulus efforts, which is favorable for stocks. However, we caution investors that pullbacks could and likely will occur, as they are inevitably inherent to investing. Such events, depending upon the environment, could present buying opportunities.

SageVest Wealth Management offers integrated financial planning and investment management services. Please contact us to find out more.

If you found this article insightful, please SUBSCRIBE.