One of the most frequent questions we receive from clients is “how much do I need to save for retirement?” The truth is, there is no one-size-fits-all answer to this question. Instead, we rely on specific personal...

NEWS & INSIGHTS

One of the most frequent questions we receive from clients is “how much do I need to save for retirement?” The truth is, there is no one-size-fits-all answer to this question. Instead, we rely on specific personal...

While the first months of the year are busy with filling out income tax forms or sending documents to your CPA, lowering your taxes should be a year-round effort. Being aware of tax law changes and how you can benefit...

2020 brings a number of changes to IRA and retirement plans as a result of the SECURE Act, signed into law in late 2019. The changes are broad, impacting virtually everyone, whether you’re a student, younger, older,...

Retirement is one of the most significant events in your life. It also makes it one of the most critical financial planning decisions. A solid retirement plan provides financial and psychological assurance. Careful...

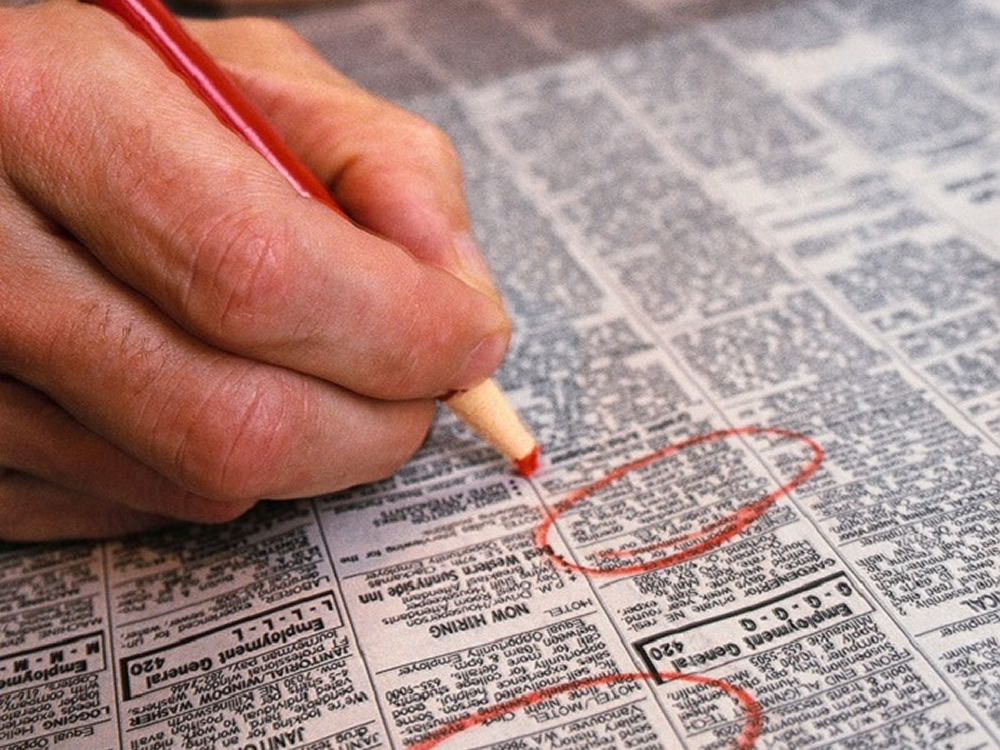

There are many reasons why you might be considering looking for a new job. Maybe you’re seeking more responsibility – or less. Perhaps your job is no longer rewarding – monetarily or otherwise. You might be relocating,...

SageVest Wealth Management recently came across an article in the New York Times that predominantly discussed mutual fund fees and alleged investment advisory conflicts. The public commentary in this and other similar...

Make a wise investment

in your future today.