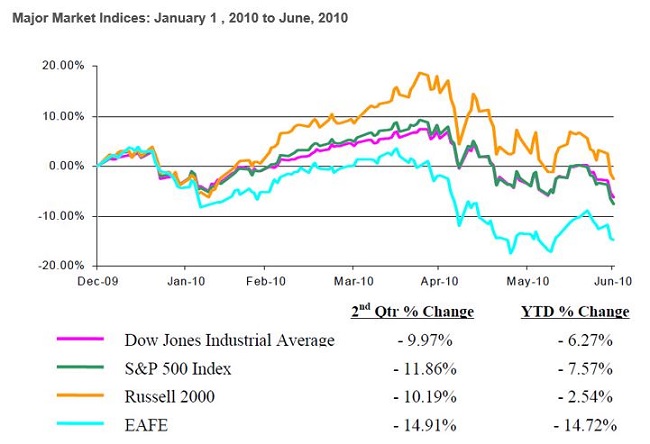

The months of May and June cast grey clouds over the markets. The Greek debt crisis and the coinciding May 6th “flash crash” quickly erased early 2010 market gains. Ensuing debt contagion fears swathed much further than the so-called “PIIGS” (Portugal, Italy, Ireland, Greece and Spain). The effects put broad government debt burdens under scrutiny, brought future economic recovery into question, and ultimately forced equity markets into negative territory for the year.

A Recovery On Shaky Ground?

U.S. government spending remains strong and many stimulus efforts are still in effect – namely continued spending under the $787 Billion Stimulus Bill. However, we are seeing the impacts of recovery pull-backs, the most notable of recent being the April 30th close of home buyer tax credits, which led to a significant drop in home purchases.

Previous attention focused on the short-term benefits of stimulus is now shifting to the lasting impacts it can achieve. The goal of government stimulus was to ‘jump-start’ longer-sustaining private sector recovery. Positive indicators of private sector recovery surfaced in late 2009 and early 2010, but the recovery remained at infancy stages when concerns about government debt and continued recovery took center stage. This leaves governments questioning if they can afford additional stimulus spending. It also leaves businesses and consumers questioning if the recovery can withstand shaky ground. The answers to these questions are still unknown. The one thing we know with certainty is that the markets do not react favorably to uncertainty – hence the chart above.

Austerity vs. Stimulus

While U.S. Federal spending and stimulus efforts remain strong, many other governments are being forced to put austerity measures into effect. This is when a government simultaneously reduces spending and increases taxes. These actions are seldom enacted in tandem as the impact of putting less money into the economy while taking more out presents strong risks for economic contraction. This is why austerity measures typically only go into effect when government debt is seen as insurmountable. This is now the case in several European countries, causing austerity plans to go into effect. It is also the case among many of our state governments running insurmountable deficits that are forcing significant spending reductions and tax increases.

The majority of the world’s sovereign nations have not reached dire circumstances that mandate austerity. Yet, this was a topic of hot debate at the recent G-20 Summit at which England, Germany and France all called for immediate austerity plans to thwart future debt crises and maintain confidence in their countries. The key opponent was the U.S. as President Obama called for the opposite – continued government stimulus. The end result was a compromise of sorts, under which each country agreed to halve their deficits by 2013 while retaining flexibility to promote recovery and job growth. It is almost certain that the U.S. will continue on a stimulus pattern while many European nations will begin more rapid spending curtailments. Such differences in approach are surely formulating some of the most interesting economic and political case studies in history.

Our expectation that short-term government stimulus spending will continue domestically but contract in Europe gives us an improved short-term outlook for our domestic economy. SageVest Wealth Management is therefore more heavily weighted toward U.S. versus European markets among our equity portfolios. The U.S. recovery is on shaky ground, but a low interest rate environment and strong company balance sheets give potential for continued recovery and job creation. Looking longer-term, debt burdens faced by virtually every developed nation pose significant challenges to growth and prosperity. This is why economic recovery is so critical – both to improve today and tomorrow.

Emerging Markets – The Rare Birds

Emerging market countries are the ‘rare birds’ in our current world economy. At a time when developed country economies are struggling to grow and facing deflation, emerging economies are taking off and trying to contain inflation. Such growth is relatively easy to explain as these countries hold key ingredients including young populations, modest social obligations, developing middle classes, increasing education and innovation, competitive wage structures and abundant natural resources.

Beyond direct investment opportunities seen among emerging markets, we are also intrigued by the opportunities that they present to developed markets. Emerging market countries are not only growing domestically, they are reaching out and making investments in developed nations. Such investments are in part opportunistic strategies and in part efforts to stabilize symbiotic economic relationships. As an example, ICBC, China’s largest bank and 70% owned by the Chinese government, recently announced a “large-loan” program designed for U.S. commercial real-estate owners in need of loans in excess of $100 million, an area troubled by a lending market void.

Bond Markets – A Perplexing Environment

As broad economic growth falls back into question, we believe in maintaining significant bond allocations to reduce portfolio risk and maintain capital preservation. The challenge is that we remain in an incredibly low interest rate environment. Under normal circumstances, this would cause bond investors to speculate higher rates are on the horizon, particularly as countries are printing money to support debt obligations. The reality is that inflation is typically ignited by strong economic growth, wage increases, heightened production and an expectation that things will cost more in the future. Current concerns about slowing economic growth and broad austerity measures create the exact opposite scenario, making deflation just as much, if not more of a risk.

Looking at our domestic economy, the largest risk that we see prompting short-term inflation is a lack of confidence in Treasuries. While we are concerned about the country’s debt levels, we do not foresee any short-term concerns about the government’s ability to repay its debt (e.g. a repeat of the Greek debt crisis).

SageVest Wealth Management’s current bond strategy is to lock in higher intermediate and long-term rates. Rates are not glamorous, but rates on short-term bonds are virtually non-existent. Furthermore, longer-term bonds offer greater return potential if fears of economic stagnation ensue. We are also incorporating meaningful allocations to international bonds, including developed and emerging market exposure as a means to enhance yields and diversification.

Fundamental Positioning

The second quarter brought fear back into the market. SageVest Wealth Management does not discount these fears, nor do we suggest that they are not relevant. What we do question are the possible perils of over-reacting in an environment where many recovery fundamentals remain intact, particularly in the U.S. and emerging markets. Austerity measures could stunt growth, but there is a dramatic difference between stunted growth and negative growth. In the current environment, we think it is prudent to maintain a strong balance of stocks and bonds – positioning that enables upside participation as well as downside protection.

As always, we encourage you to contact us if you would like to discuss the structure and composition of your investment holdings in greater detail.

If you found this article interesting, please SUBSCRIBE.