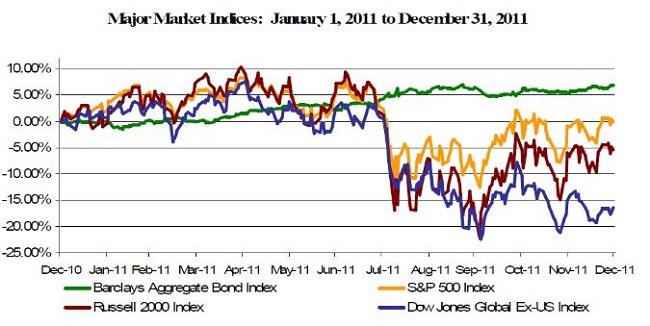

It was a frustrating year on Wall Street, but the fourth quarter of 2011 was a real turnaround from the third. However, the stock market still posted a sub-par year due to incredible events including an earthquake, tsunami and nuclear meltdown in Japan, riots throughout most of the oil-producing Arab world, the first ever downgrade of the United States’ credit rating, and spreading debt problems throughout the European Union. The resilience of our U.S. markets throughout this period is somewhat astounding. Following is SageVest Wealth Management’s look at significant developments of the quarter, including improved economic indicators, and thoughts moving into 2012.

The S&P 500 soared 11.15% in the fourth quarter, dodging a bear market and ending the year flat. Inflation and unemployment declined, manufacturing activity continued to expand and housing appeared to offer discernible hints of a rebound. Capitol Hill bickering may have irritated Main Street, but it didn’t take the enthusiasm out of the consumer during the holiday season. Europe faced a real possibility of recession as two prime ministers resigned and the European Union risked fracture under the burden of its collective debt crisis. Yet, the quarter ended with consumer and investor sentiment seemingly improved in America.

As the quarter unfolded, the news got better, especially domestically. September’s unemployment rate of 9.1% declined to 8.5%, as recently reported for December. This is the lowest unemployment reading since March 2009 and several months of employment recovery offer a strong domestic outlook moving into 2012.

Improvements in the employment market helped to boost consumer and corporate spending, showing additional signs of recovery throughout the economy. Consumer confidence figures offered considerable rebounds, largely exceeding expectations. Furthermore, upticks in manufacturing and durable goods offer important fundamental growth indicators.

A notable comment is that these gains occurred in spite of an incredibly dysfunctional Congress. The “Super Committee” failed to come up with a deficit reduction plan, triggering $1.2 trillion in involuntary cuts to the federal budget in 2013, including major cuts to defense spending. Later, Republicans and Democrats were only able to reach a 2 month compromise, passing an extension of the payroll tax holiday, long-term jobless benefits and Medicare payments to physicians at the current level through February 2012. While there were a number of frustrations throughout 2011, perhaps the most frustrating is to contemplate the additional growth that could have been achieved if our government leaders had actually been able to reach necessary long-term accords.

Europe

There were a number of impediments to the global economy in 2011, but the European debt crisis was and remains the most significant. The debt crisis that began in Greece two years ago spread much further and deeper in 2011. The theory of debt contagion throughout Southern Europe has quickly become a reality.

The quarter passed without Greece defaulting, but new fears about Italy seized the headlines. In October, there was a collective sigh of relief when German Chancellor Angela Merkel and French President Nicolas Sarkozy convinced EU banks to bolster capital ratios and accept 50% writedowns on Greek bond holdings. There was also a vow to increase the size of the Eurozone bailout fund. However, by year-end, Italy, the 3rd largest economy in the EU and 8th largest in the world, reported a $2.7 trillion deficit and faced significant hurdles in financing its debt. Domestic response within Greece and Italy led to the resignations of the respective Prime Ministers, George Papandreou and Silvio Berlusconi.

Europe has instituted several initiatives ranging from direct financial support to stricter fiscal mandates; and, while the list of initiatives is quite long, the impact has been rather weak. A ‘muddle through’ approach of infusing liquidity is clearly not addressing European solvency problems.

A large obstacle to the solution is that the cure is part of the problem. Austerity measures – reducing spending while simultaneously increasing taxes – are having dramatic impacts on troubled European countries. Each of these economies needs to experience growth in order to repay its debts. However, reductions in government spending are cutting deeply into European economies where government spending on average represents between 40% and 50% of the overall economy. Therefore, while it’s easy to understand the political stance of saying those countries that have spent too much need to exercise greater financial discipline, leaders must also recognize the need to create alternative paths to private sector growth or to create a cohesive European solution.

Greece is case in point. Despite rounds of bailouts and significant cuts in government spending, Greece recently warned that a default is imminent in March unless European negotiations render another bailout. These impending decisions about Greece, combined with vast amounts of new bonds that must be issued by Italy and Spain (approximately $225 billion combined) in the first quarter, could force Europe’s hand toward more substantive actions. To this end, three long-term solutions are primarily considered:

- Unify all European debt: Europe’s fiscal landscape could dramatically improve if the debt of each individual country was centralized under one common structure, similar to that of the United States’ federal structure. Although this is the most direct solution, it would require financially stronger countries to assume the debts of others. Additionally, it would require a new global fiscal framework within Europe.

- Allow Weak Countries to Leave the Euro Currency: Countries facing significant debt burdens could exit the Euro zone currency. An exit would remove financial support burdens imposed upon remaining countries and could allow exiting countries to gain a more competitive currency structure. The primary challenge would be short-term currency and liquidity impacts to both the exiting country(ies) and to the Euro during the transition.

- A German-led Exodus of Northern Creditworthy Countries: Conversely, the stronger Euro-zone countries could exit the Euro currency. This would remove external debt burdens from exiting countries, and the stronger European countries would likely be able to transition out of the Euro currency with fewer short-term ramifications. However, an exit of the stronger countries would significantly fracture the original objective of creating a more unified Europe.

Outside Of Europe

Looking outside of Europe, Japan obviously faced the most significant challenges in 2011 in the wake of earthquakes, a tsunami and a nuclear meltdown. Recovery efforts will be long standing, but are underway and the future of Japan is far more promising than most would have expected earlier this year.

Emerging market countries surprised many investors in 2011 as their stock markets experienced significant declines despite continued strong economic growth. The divergence is somewhat of an oxymoron, but demonstrates how emerging markets remain highly dependant upon performance and demand of the world economy. Long-term we continue to believe that emerging markets are a critical element in the investment landscape and that stock valuations will resume a similar trend line to economic growth.

China’s economy remains under critical scrutiny as its growth has been contracting and housing prices have been falling. Part of what sparked concerns was inflationary pressures, which have fortunately begun to subside. Our expectation is that China will experience a ‘soft landing’ under which growth will continue, but perhaps closer to 8% versus 10%.

Finally, while conflict continues in North Africa and the Middle East, Iran sits at the forefront of economic considerations as it threatens to close the Strait of Hormuz in retaliation to sanctions for nuclear initiatives. Oil supply disruptions would be significant if they act upon this threat, but we anticipate the duration would be limited given wide scale global pressures and the negative economic impacts that would boomerang back on Iran.

Portfolio Positioning

Looking ahead into 2012, we remain optimistic about additional economic recovery, particularly in the United States and among emerging markets. We also remain realistic and recognize that challenges will persist, the largest of which is seen to be the European debt crisis. Our hope is that formidable results will emerge from Europe. In the interim, we caution investors that the markets could experience continued volatility and we are therefore maintaining a conservative posture with a bias toward domestic equities.

We understand that many investors are tempted to wait on the sidelines until things become more certain. This could prove to be a wise decision, but it could also result in significant lost opportunities as demonstrated by dramatic rebounds that have occurred following virtually every initiative Europe has implemented. An important investment doctrine is maintaining a long-term investment outlook. SageVest Wealth Management remains focused on this outlook while holding a defensive posture in support of capital preservation objectives.

As always, we invite you to contact us with any questions about your financial and investment considerations.

If you found this article interesting, please SUBSCRIBE.