SageVest Wealth Management recently released our quarterly commentary for year-end 2016. Highlights are as follows:

– The first quarter set new market highs in the Dow Jones Industrial Average and S&P 500 indices.

– While the markets remain strong, warning signs could be emerging, including political discord, rising rates and high valuation levels.

– Investors are encouraged to be mindful of risk exposure in pursuit of their desires to both grow and preserve.

Post election market euphoria continued into the New Year, lifting US stocks to new highs in 2017. The Dow Jones Industrial Average crossed 21,000 and the S&P 500 briefly topped 2,400 for the first time. Positive stocks returns are not just US-based; they’re generally global, giving a strong boost to stock investors. In fact, recent returns have been so robust that if they continue their momentum, we could be poised for an incredibly profitable year. However, that’s always the question: Will recent performance continue, or will it wane as the year progresses?

The month of March brought new highs. However, it also brought market stumbles, including a few nasty down days as uncertainty began to muster on the political front, about interest rates, and about future growth potential. We’re cautiously optimistic looking forward, but also feel it’s an important time to take heed of warning signs, making sure you have the right portfolio structure for both upturns and downturns in the markets.

US Political Impacts On The Markets

Much of the market’s luster since President Trump’s election has been based upon anticipation of broad-sweeping changes across regulations, taxes, trade, infrastructure spending and more. It was widely considered that a Republican President, coupled with a Republican sweep of the House and Senate, would pave the way for swift action on campaign promises.

The recent health care bill proposed by the Republicans was the biggest test of the Republican Party since President Trump took office. President Trump tried an ultimatum with his party and walked away empty handed as the bill was retracted due to a lack of support. The failure of the Republican’s health care bill has been significant, not just because of health care reform, but because of the discord it highlighted among the Republican Party. The results of the bill’s failure, and of other political setbacks, have led to a growing lack of confidence in the outlook for the wave of changes that President Trump promised.

From an investment standpoint, businesses and investors have been banking on a more accommodative environment, with a pro-growth focus. There’s no doubt that President Trump’s intentions remain focused, but there is growing doubt about his ability to enact change in a contentious political environment, potentially impacting the sustainability of the recent market rally.

European Elections And Brexit

The European markets have also been enjoying a strong start to the year, despite facing challenges on the horizon. After a wave of populist election results, the Netherlands steered clear of a disruptive populist voting outcome. However, more elections are due this year, including two significant European leadership contests in France (in April/May) and Germany (in September). Anti-immigration sentiment remains strong throughout Europe and could lead to some surprise election results, as we saw in Britain last year.

Speaking of Britain, Prime Minister Theresa May formally triggered Article 50 on March 29th, officially commencing the separation of Britain from the European Union. This alone will bring a number of headline stories and changes over the next two years, as Britain negotiates new trade agreements and navigates its new standing among other European countries and the world.

Another Fed Interest Rate Hike

In March, the Federal Reserve Board (Fed) raised rates by a quarter point again, for the third time. This brings the Federal Funds Rate into the 0.75% to 1.0% range, which is higher than where we’ve been for years, but it’s hardly a threshold of concern, relative to historical levels.

While rising rates in recent months have diluted bond returns, it’s important to remember that a hike by the Fed doesn’t always equate to a rise in market rates. In fact, longer-term rates have fallen two out of three times following the Fed’s recent efforts to raise rates. This goes to show that market forces and inflation expectations remain key drivers to interest rates and bond prices.

That’s not to say that we won’t see an eventual rise in interest rates. We ultimately believe rates will move higher, given the strength in the economy and emergence of inflation. It’s noteworthy that February’s consumer inflation exceeded the Fed’s 2% target for the first time in nearly five years.

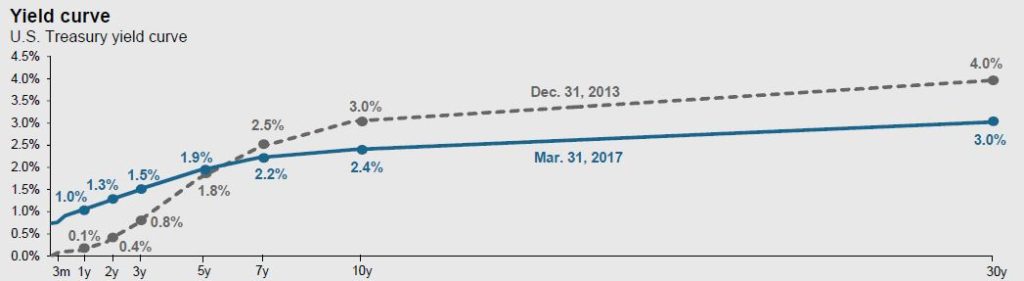

One thing we are watching closely is the movement of short-term rates relative to long-term rates. Whenever the yield curve inverts (when short-term rates exceed long-term rates) it’s a potentially ominous sign for the economy and for the markets. As the chart below illustrates, long-term rates have been falling since December 2013 (shown in the dotted line) as compared to current rates (shown in the solid line). Conversely, short-term term rates have been rising.

Source: FactSet, J.P. Morgan Asset Management

Fortunately, the yield curve remains reasonably healthy, with long-term rates still well above short-term rates, but we’re carefully watching to see how closely short- and long-term rates might veer, potentially elevating market risks.

Lofty Stock Prices

As we discussed last quarter, stock price valuations are becoming a point of concern. Price-to-earnings valuations are much lower than the ultra-highs typically seen before a downturn, but they are becoming a bit lofty, particularly after the strong recent run in the stock markets. Current stock prices could be sustainable if the economy and business earnings continue to grow. However, if growth and earnings stagnate, relative to stock market bullishness, we could be in for a correction. All eyes are on the ability to get the growth engines going, as the markets assumed would occur when President Trump took office. The next few months should be telling about his true potential to navigate the political arena in pursuit of his agendas and in support of US growth initiatives.

Looking Ahead

Fortunately, we still see plenty of positive indicators that could allow the markets to continue flourishing, and we certainly hope that they will. At the same time, we believe it’s important for investors to be cognizant of potential market warning signals.

We recently trimmed back on stocks, taking a few profits off the table in instances where stocks had accelerated beyond our target allocations. We encourage investors to review overall stock exposure, making sure your positioning affords the growth you desire but also the protection you need.

As always, we encourage you to contact us with any questions.