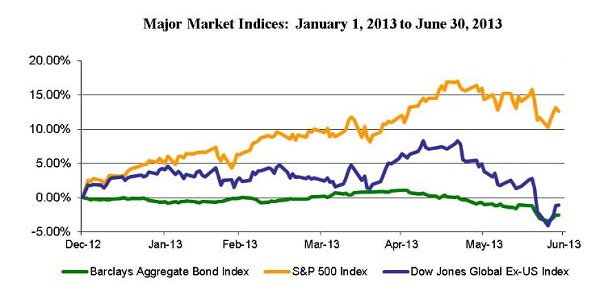

June brought a bumpy landing to the second quarter as the Federal Reserve Board (Fed) signaled likely tapering in its bond buying program, and news from China raised liquidity concerns for the second largest world economy. US stocks, the starlets of 2013, managed to retain significant YTD returns. Dividend paying stocks retreated as bond yields became more attractive, but US stocks on the whole remained rather resilient. Looking elsewhere, returns turned negative among international stocks (largely emerging markets), bonds and commodities alike.

In summary, performance was extremely mixed and rendered a somewhat uncommon result where one asset class stands out as an investment oasis for diversified investors.

Fortunately, our equity allocations have remained overweight toward US companies, feeling the strength of US stock market performance. Additionally, within bonds, we have acted to reduce overall duration, which helps to mitigate the impacts of a rising interest rate environment. These tactical decisions have benefited clients. However, while we have implemented strategic actions, we remain diversified, even at a time when some might say that diversification is broken.

When one investment significantly outshines others, it is common to ask: “Why don’t we buy more?” Similarly, when an investment begins to contract, one tends to ask “Should we sell out?” Assets sparking these questions in today’s environment are US stocks as they outshine other assets, and bonds as interest rates draw returns into question. We speak to each of these questions in this commentary.

Additionally, we remind investors of the long-term benefits of diversification. Technically, one investment will always outperform others. However, time has proven that one investment never consistently dominates – see the Historical Asset Class Returns chart. While higher risk assets tend to land in top rung positions over time, they also bring volatility that might not align with your investment goals or temperament. Recognizing these considerations, we continue to favor a diversified investment strategy that is focused on the long-term, while making tactical adjustments in response to our current investment outlook.

Historical Asset Class Returns

Equity Market Perspectives

The US stock market has remained resilient throughout the past 4 year recovery period. Aggressive government and Federal Reserve actions have had a material impact in allowing our economy to regain financial strength. Consumer demand has remained resilient and employment figures are increasing. Perhaps more important, the housing market is finally staging a strong recovery and the energy industry shows promise for achieving an energy independent future. All in all, there are many things to celebrate domestically, and this is why we continue to favor US stocks from a world perspective.

Continued strength in the US equity market could persist for a multitude of reasons. However, several fundamental factors support exposure to international markets, even at a time when they appear lackluster. First, international stocks are attractive from a valuation standpoint. It is also important to recognize that a long list of thriving world companies operate outside of the US, including numerous multinational companies that are household names here in the US. Looking more specifically at regions, Europe is beginning to see signs of a possible recovery, with leaders recognizing that austerity measures might need to take a back step in support of growth objectives. A resumption of growth in Europe would mark a dramatic shift from recent years, perhaps sparking new demand in the region. Japan is also taking aggressive actions to stimulate its economy with positive initial indicators, including the first signs of deflation easing.

In addition to noting positive attributes internationally, we also believe it is important to recognize two possible headwinds to our domestic markets. Support by the Federal Reserve, which has bolstered the US stock market in recent years, could be drawing to a close. Any actions by the Fed are anticipated to be gradual, essentially implementing a ‘weaning’ process; but still, less is less. This could bring a new test to the US stock market as domestic growth becomes more dependent upon true economic growth versus monetary stimulus. At the same time, other central banks are remaining engaged in monetary support, possibly giving a ‘leg up’ to international markets looking forward.

The other key variable is the rising value of our dollar. A stronger dollar helps if you are traveling abroad, but it could have a dampening effect on US companies that compete globally. Thus far, slightly higher strength in the dollar hasn’t had much impact. However, if the Fed cuts monetary stimulus while other central banks remain engaged, we could see the dollar move higher.

Recent Bond Activity

Interest rates moved sharply higher in June, largely in response to the Fed’s June meeting remarks. Higher rates have caused bond prices to contract and have increased borrowing costs throughout the country. This rapid move is prompting many bond owners to question the merits of owning bonds.

Before discussing the reasons for maintaining bond exposure, we preface this discussion with a few remarks. We have generally pulled back on bonds in a few ways given concerns and now substantiation of a rising interest rate environment. We have reduced bond exposure among many portfolios and, in selected instances, have adjusted portfolio targets to reduce bond mandates. Additionally, we have taken actions to limit the duration of bond holdings, which helps to reduce interest rate risk. While we are keenly aware of the risks that a rising interest rate environment could bring to bonds, we must also ask and consider the following questions regarding any further actions, or a possible exit from bonds.

Is it time to abandon bonds? Bonds tend to be a safe haven during high risk periods. Hence, abandoning bonds would require investors to effectively conclude that interest rate risk is the only risk parameter facing the markets. We feel that this is false. Economic recovery is generally still underway, but market risks still exist, both domestically and abroad.

What are the alternatives? If you exit bonds, your options generally are to sit in cash or move further into stocks. Cash is effectively earning zero return, meaning that investors must accept the risk of losing purchasing power and giving up income. While stocks are growing in value, they inherently entail far greater risk, which may not be appropriate for your overall risk tolerance or in support of your income needs. Furthermore, US markets are near their all-time highs, adding to current purchasing risk.

What are the risks of timing an exit and re-entry? Interest rates have already experienced a significant reaction to the Fed’s comments, and the impacts of any initial Fed actions could already be factored into bond prices. Exiting bonds now would require an outlook that additional Fed actions are highly probable. This could be the case, but sequential Fed steps are anything but certain. The Fed is clearly testing the waters to gauge market reaction and economic stability before implementing changes. One clear test will be the impact of higher mortgage rates on the recovering, but still fragile, housing market. The Fed has expressed its outlook for reducing monetary stimulus, but their actions are far from being set in stone. In fact, looking to the recent past, the Fed has twice reduced stimulus only to resume again.

Reflecting upon the above, our preference regarding bonds is to retain shorter-term duration portfolios, with slightly minimized exposure to bonds. This strategy seeks to continue generating yield, while ensuring portfolio liquidity, without trying to market time interest rates.

Investing Going Forward

SageVest Wealth Management continues to focus on long-term investment objectives with support of maintaining a diversified portfolio that incorporates tactical positioning, as partially discussed in this commentary. As always, we invite you to contact us with any questions regarding your portfolio or financial considerations.

If you found this article interesting, please SUBSCRIBE.