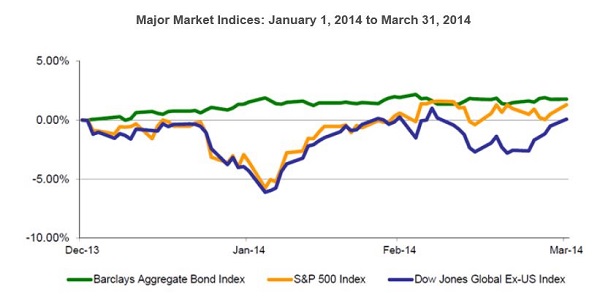

After a stellar year for the stock market in 2013, the first quarter ended largely unchanged, yet with a fair amount of volatility along the way.

Stocks eked out modest gains, allowing the extended bull market to celebrate its fifth birthday in March, making this the sixth longest bull market since 1928. Bonds posted the greatest returns as investor confidence began to wane, causing flight into the safety of Treasuries. Bonds surged 1.8% in the first quarter, reflecting investor fatigue towards growth in the midst of Fed tapering, one of the worst winters in history and geopolitical uncertainty in the Ukraine that resurrected coldwar tensions with Russia.

The choppy start to the year serves to remind investors that the investment markets are susceptible to risks some that can be foreseen, and some that no one on can predict.

Welcome Spring!

Whether you’re one of us living in a winter weather-beaten state, or simply an investor waiting to see better economic data, let us join together in welcoming Spring! The polar vortex and unrelenting storm patterns of the winter took a toll on the economy, except for a lucky few such as winter gear outfitters. Corporate, job and economic reports were all anemic, including some reports still being released for the winter months. Fortunately, we are starting to see improvement as Spring breathes life back into the economy.

Some demand will certainly remain foregone as high energy bills permanently redirected a segment of spending. However, SageVest Wealth Management believes there is still plenty off pent-up demand that is just now filtering through the economy. Second quarter reports could prove to put a bounce in everyone’s step as consumers exit winter hibernation. We are optimistic about a potential surge in spending, both by consumers and businesses, which are widely projected to expand corporate spending in infrastructure, technology and hiring in 2014. All could prove to bring cheerier days later in the year.

Fed Tapering A Sign of Growth or A Signal of Contraction?

There’s an adage of “Don’t Fight the Fed”, suggesting that the Fed’s stimulus efforts almost always result in strong results for the stock market. This begs the question of how to approach investments as the Fed begins to taper its fourplus year quantitative easing (bond buying) program.

First, we believe it is important to acknowledge that while the Fed is reducing the quantity of bonds it is buying, it is still buying and thereby still creating a growth environment. Second, there is no current discussion of selling the vast quantity of bonds now owned on the Fed’s balance sheet. Thus far, the expectation extended by the Fed is that these bonds will naturally mature, rather than being sold. This is again a positive sign in terms of supporting growth. Third, our economy is growing at a pace that is prompting the Fed to taper. In other words, the Fed finally believes the economy stands strong enough on its own fundamentals to sustain growth, which is certainly a positive variable.

The above said, the one thing investment markets do not like is uncertainty, and the unwinding of unprecedented monetary action presents just that. There is no period in history upon which investors can reflect to surmise the results of Fed tapering. Even if historical precedent did existed, the number of interconnected variables that change on a daily basis makes the Fed tapering ‘recipe’ extremely complex. This leaves investors (and the Fed) in uncharted territory, making it a delicate process of sequential decision making.

Thus far, the markets seem to be absorbing Fed tapering in relatively good stride as the Fed has now implemented its third sequential pullback in bond buying since yearend. However, slight modifications in the Fed’s stance can easily rattle the markets, as we saw on March 19th during Fed Chair Janet Yellen’s first press conference. It is believed that her remarks were slightly mistaken, but an inkling of earlier than expected Fed fund rate increases spooked the markets, causing an almost instantaneous tripledigit loss in the Dow Jones Industrial Average.

Looking forward, we expect Fed tapering to increase market volatility, likely both to the upside and the downside. Such volatility could require stronger longterm investment conviction.

Inflation A Worry or A Wish?

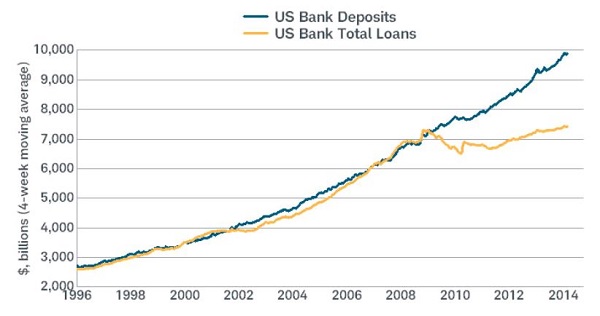

When the Fed began quantitative easing, inflationary concerns were widely discussed. This is because the Fed’s program was designed to ‘pump’ cash into banks and the economy. Thus far, much of that money has remained on the sidelines, with bank deposits far exceeding bank loans (see chart below).

A lack of bank lending and large sums of cash sitting on the sidelines has been a hindrance to economic growth in recent years. Fortunately, just as winter is thawing, we are also seeing a thawing in lending restrictions and a recent upsurge in bank lending. New lending activity could finally help to lift economic growth, which would certainly be good news. The only caveat is that a sharp upswing of money flowing into the economy could also trigger inflation.

Just like many things in life, moderation is best when it comes to inflation. Too little inflation can be just as detrimental as too much inflation. If we look to our friends in Japan, more than two decades of deflation have caused perhaps irreparable damage as an entire generation has experienced zero growth. Conversely, we recall the impacts of rampant inflation in the 70s, which presented oppressive purchasing and affordability constraints. Inflation exists in an ideal world, just as long as it doesn’t get out of hand. In the current environment, we believe that a slight uptick in inflation could prove positive for the economy. And, while it is something to keep a keen eye on, we are mindful of the fact that much of the world is still combatting deflation or ultralow inflation, notably in Japan and Europe. One meaningful exception could be China, where growth in their economy is causing significant wage growth, netting price increases for goods and services that flow into our economy.

For now, we remain cautiously optimistic, but with a close watch on both rates and inflation.

Valuations

A final market variable on which we will comment is stock valuations. P/E (price to earnings) multiples have been running a bit high, and the S&P 500 Shiller Cyclically Adjusted P/E suggests that P/E multiples are at excess levels relative to longterm averages.

There is no doubt that our US stock markets are no longer ‘cheap’. That said, P/E multiples are based upon two components: stock prices and earnings. If corporate earnings can continue to grow, P/E multiples shouldn’t be a problem, particularly if economic demand picks up with new bank lending, improving employment markets and a possible upswing in business spending. Furthermore, if we look at the spread between corporate earnings and bond yields, stocks remain favorable.

Our sense is that we are in the ‘grand middle’. There might be small bubbles in the economy, such as the social media and biotech sectors, but we believe the economy as a whole is far from bubble territory. This is the point at which stock market returns are no longer a ‘home run’, but still feasible if the economy remains on a stable footing.

In Summary

The first quarter was hopefully a slight anomaly due to the impact of winter, but also served as a worthy reminder that the markets can be fickle and reactionary. As we look forward, we believe it is important to recognize and celebrate the fact that the economic fundamentals that supported growth over the past five years remain intact, with many continuing to grow stronger. At the same time, we also take heed of the uncertainty surrounding Fed tapering and international developments, both economic and geopolitical. We advise clients to remain focused on longterm investment objectives, and continue holding a mixture of investments carefully selected in pursuit of achieving longterm financial growth without absorbing excess risk.

As always, we encourage you to CONTACT US with any questions.https://www.sagevestwealth.com/changing-investment-climates-from-weather-to-world-politics/

If you found this article interesting, please SUBSCRIBE.